I have loved reading Indeedably’s Sovereign Quest challenge ‘Planning for Decumulation‘, including Weenie, FI UK Money and Gentlemen’s Family Finance. I may be a bit late to the party but thought I would put my two penneth in. It has been an interesting to contemplate and work out some of the detail.

Until thinking about this challenge I was like Weenie – I had a high level plan that has some shape to it, but the nitty gritty was, and still is to some extent, less sure about. Am hoping to use this post to flesh out some of that detail and would love to get some views.

On paper I could FIRE in a year at aged 55 but I am considering working a couple of years as a) I’d like that little bit more annual income those two years could give me b) I don’t hate my job and c) I could have the opportunity to work part time. Anyway for the purpose of this post I have compared two options

- Leave work and take my DB pension at 55

- Continue working full time and take my DB pension at 57

And am assuming working part-time will give me somewhere in the middle. As I said I don’t mind my job, I like it and my colleagues – it’s just the doing it every day thing that bothers me!

I think my situation is relatively simple as a key part of my plan is a DB pension which I can take at 55 so I don’t have to worry too much about running out. Also to clarify to increase my DB pension I will be taking 0 tax free lump sum.

Assumptions

I am married but I do my FIRE journey and calculations just for me, not as a couple. My assumptions are that my partner will carry on working and earning until the state retirement age, currently 67 for us. They will then have a state pension with a goal (mine not necessarily their’s!) of about of £150,000 in a SIPP.

It is possible we will both inherit some money in the tens of thousands but this is not included in any of our calculations.

Other assumptions

- 4% withdrawal rate for DC pension and ISA

- All current tax rules

- The pension modeller provided by work is correct

State pension

I include the State Pension in my figures because a) it doesn’t work unless I do! and b) because of my age and c) because I cannot see any party having the political will to challenge a universal state pension based on contribution in favour of means testing. I cannot envision a world in which a government runs an election campaign which says ‘you know that state pension all previous generations have had and you are paying the National Insurance Contributions toward – well it won’t be there for you, in fact – if you work hard and save toward retirement we’ll just take it off you pound for pound’.

The other two options DR FIRE ponders are

- Raising state pension age

- Removing triple lock

Both of which are definitely viable, but not means testing, in my view.

What type of life do I want?

I am making sure I continue building my talent stack at work as I may want to or need to work beyond 57 to have the type of life I plan for.

I will want to extensively travel so that will need funding, though when travelling I am happy to stay in hostel type accommodation, get buses and trains and manage bookings myself which all keeps cost down. I also love doing walking and cycling holidays close to home so again that can help manage costs.

All things I love doing are relatively low cost, running, cycling, walking, socialising, cinema a bit of theatre and art galleries – I can cut my cloth to fit if needs be and do not have many expensive habits.

Behavioural

I do enjoy the daily interaction with people that a job brings, but I think I can through social networks, working and volunteering emulate that in my post work FI lifestyle.

I also have a couple of work / study / career change options I am exploring so who knows. I also have hobbies and things I like doing and would like to do more of so am thinking having time on my hands will not phase me. My parents are getting older and I do want to spend more time with them. Even though we all know none of us live for ever, to be faced with the fact our time together is limited makes me think I want to be there for them if they need me to care for them.

Legacy

I am child free and whereas I love my nephews and my great nephew I am not planning on leaving them lots of money, but if I do it is split 50/50 between people and charities.

The figures

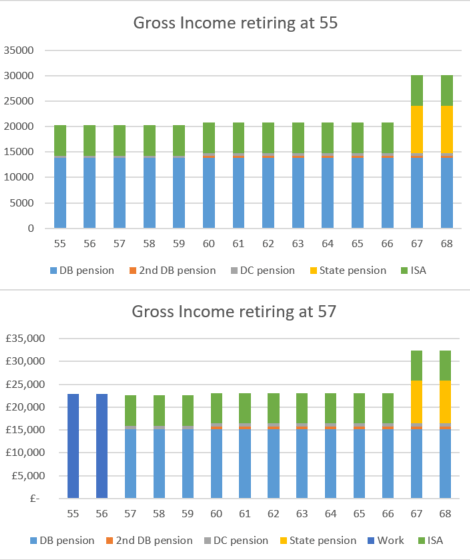

So looking at my figures, the majority of my post FI lifestyle will be funded by DB pension, topped up with my ISA investments, a thin sliver of a small DC pot and an even smaller second DB pot (available from aged 60) from my first job after A Levels – and the State Pension from 67.

Whether I retire at 55 or 57 up to state retirement age about two thirds of my gross income will be from by DB pension, between 2-3% from my DC pension and a third from my ISA. So two thirds of my income will be index linked free of volatility worry.

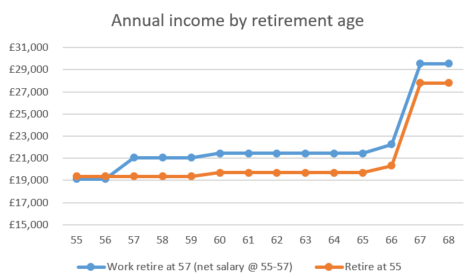

What I have worked out is that my FI net income is more than my net current income! (i.e. my living and discretionary spends, not including my savings and investments), by just £150 if I retired at 55 but by nearly £2,000 net if I work the extra 2 years and continue with the same level of savings and investments.

I had never done this specific calculation before so it has been really illuminating and brings me comfort.

Also if I work for another two years I will have around £1,700 more per month, with a total net income of around £21,000. And this feels alright, well more than alright, it means I am not lean, but not fat.

According to the Retirement Living Standards this is a Moderate income for an individual and is two thirds of a couple’s Moderate income. So as a household it is indicating to me that we will be fine as my partner will carry on working until 67 and then we both will get State Pension which may, with the wind in the right direction, get us to Comfortable for a couple standard of living.

It has taken quite a bit of work to get down to the last pound and penny on these calculations but even though I am between 1-3 years of hitting FI, things can change with numbers, I do need to get the pension numbers validated and just doing this exercise has me changing my plans!

Also as a result of the MCR FIRE meet up session on Friday March 19 with Indy, a Financial Advisor, I have been challenging myself as to why I am putting so much in my Stocks & Shares ISA and am not taking more advantage of the DC scheme available through my work (in addition to the DB scheme). Indy also has made me think about the role of the tax free 25% of the DC pension in my planning. So no sooner have I written this than I am changing my accumulation principles – however the idea is that the numbers will be similar, if not better but the S&S ISA plays a less significant role.

It has taken me a while to do this post but have enjoyed it. I think I know my numbers but being more forensic about it has given me a lot more clarity, plus it has, along with the MCR FIRE meet up session, made me reflect on my accumulation strategy.

I would definitely encourage people to do this. Am also interested in any thoughts anyone has on what I could improve on.

Looks like a good plan! I think it makes sense to include the State Pension if you’re mid-50s and only 10-15 years away from claiming it. I agree with you, I don’t think they’d make any drastic changes for those that are so close to claiming. In my case, mid-30s, I think I’m sufficiently far away that changes to the State Pension become a greater possibility. So, for now, I’ll ignore it, and only start to factor it in when I’m about 10 years away.

Choosing between retiring at 55 or 57 is a good place to be! Sounds like you’re leaning towards working to 57 at the moment, for extra income?

LikeLike

Sounds like a very good plan – despite not going into the nitty-gritty, there’s a lot more depth and thought in your plan compared to mine, although you are closer to FIRE than I am, so understandable.

I’m with you on the state pension – I can’t see the government changing anything too drastic; my only concern is the accuracy of the online estimate, given that I was contracted out for most of my career – is this the same for you, ie you were contracted out too?

Interesting how working an extra two years will give you the option of a better quality life (bigger holidays!). I too have been guided by the Retirement Living Standards, although I can’t see myself getting beyond the Moderate lifestyle.

The recent FIRE session with Indy was very useful and has made me think about my own ISA and SIPP balance.

LikeLike

Ahhh you have made me think here Weenie – I did contract out, I think, it was a time when I had no idea about what was what in relation to pensions and finance. Does the online estimate take into account contracting out? I have a statement that says which years I have paid NI contributions for but it does not tell me if I was contracted out, you think it would wouldn’t you ? may be need to investigate this one.

LikeLiked by 1 person

If you were contracted out, there should be mention of it the website and there should be mention of a COPE estimate too. However, I don’t think it’s really clear and I’ve read stories of people finding that their ‘estimate’ was not right when it came to actual payment.

Happy to go on a Zoom chat to discuss if you want, if only to bounce ideas/questions off you!

LikeLiked by 1 person

Thanks will have another closer look but will get in touch if I need help – thanks for the offer !

LikeLike

Thanks for reading and commenting! Yes you are right, I would love to feel like I could do anything and that extra amount would get me there. However I think I will definitely ask to work part time from 55, maybe 4 days or even 3 which will reduce my pension and ability to save and invest but should just add that little bit extra to the pot. I’ll also have more time to explore and set up post FI work / study.

LikeLiked by 1 person